POLICY OVERVIEW

Maintain American Access to Clean, Advanced Biofuels

Many observers were surprised last year when Brazil imposed a limit on duty free ethanol imports. With the tariff-rate quota (TRQ) policy in place since September, we take a closer look at this temporary solution to what UNICA hopes will be a temporary problem.

The Issue

To enhance America’s energy security and improve the environment, Congress created a program requiring increasing volumes of renewable fuel in the U.S. energy supply. The law – known as the Renewable Fuel Standard (RFS) – calls for Americans to use more renewable fuel each year, incrementally growing the requirement to 36 billion gallons by 2022. Congress capped conventional corn ethanol at 15 billion gallons to stimulate innovation and development of advanced biofuels that offer superior environmental benefits.

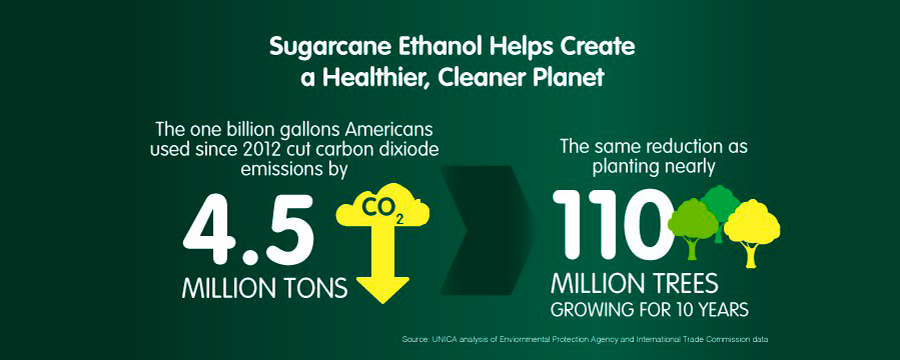

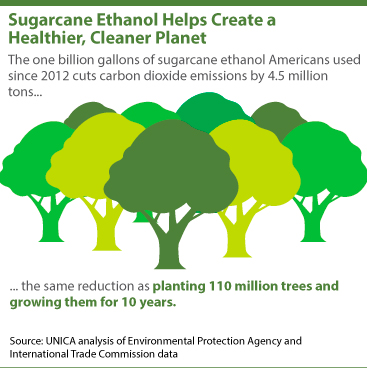

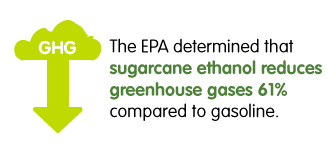

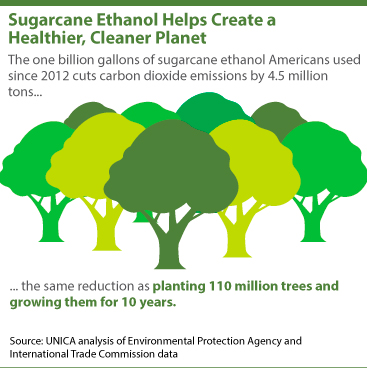

The U.S. Environmental Protection Agency (EPA) administers the RFS and determines which fuels qualify as advanced biofuels. The key condition for this designation is reducing lifecycle greenhouse gas emissions by at least 50% compared to fossil fuels. EPA identifies Brazilian sugarcane ethanol as an advanced biofuel because it reduces green-house gases by at least 61% compared to gasoline.

Our Position

Americans deserve continued access to sugarcane ethanol, one of the cleanest and most commercially ready advanced biofuels available today.

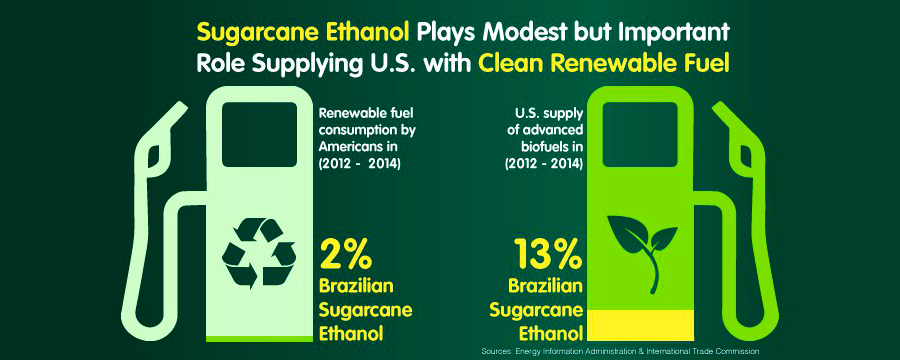

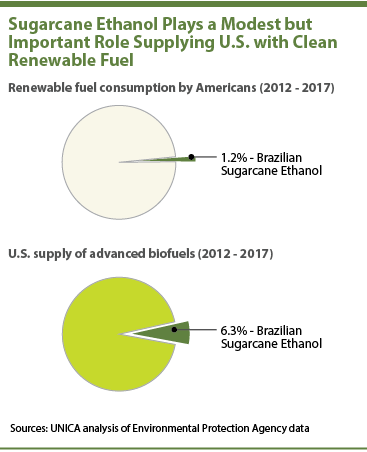

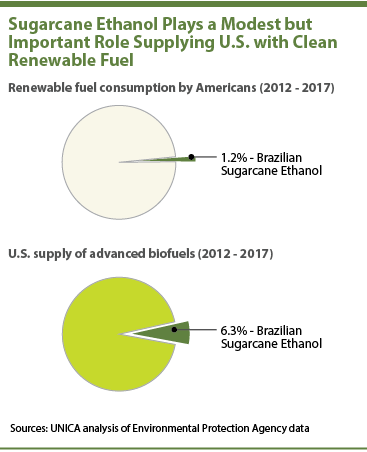

This advanced biofuel from an American ally plays a modest but important role supplying the United States with clean renewable fuel. Over the past six years, nearly 1.3 billion gallons of sugarcane ethanol imported from Brazil flowed into American vehicles. During this time, sugarcane ethanol comprised only one percent of all renewable fuels consumed by Americans, but has provided more than six percent of the entire U.S. advanced biofuel supply.

Congress designed the RFS to stimulate superior renewable fuels like sugarcane ethanol. This advanced biofuel is a reliable option for diversifying energy supplies and improving U.S. energy security so Americans are not dependent on any one source or country. Americans deserve access to cleaner fuels, and Brazilian sugarcane producers support efforts by EPA and others to preserve a strong role for advanced and cellulosic biofuels under the RFS.

Background

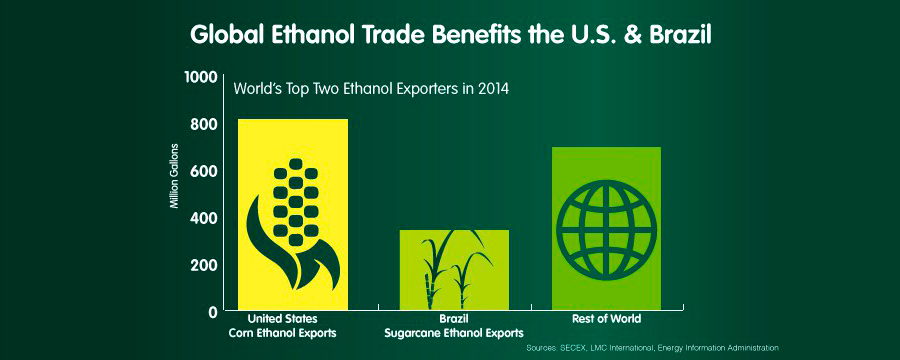

As the world’s largest ethanol producers and exporters, the United States and Brazil enjoy the benefits of trading renewable fuels. Together, the two countries have built a global biofuels market providing clean, affordable and sustainable solutions to our planet’s growing energy needs.

Brazilian sugarcane producers are making investments to expand production, and Americans can depend on more advanced biofuel from sugarcane. Brazil currently produces more than seven billion gallons of sugarcane ethanol each year and typically makes between 400 million and 800 million gallons of its annual production available for other countries to import.

The benefits of using sugarcane ethanol are cleaner air and enhanced energy security. Those benefits will grow as Americans consume more advanced biofuels.

Frequently Asked Questions

Frequently Asked Questions About Sugarcane Ethanol and the Renewable Fuel Standard

What is sugarcane ethanol?

Ethanol is the general term for alcohol-based fuels produced by fermenting many different plants. Sugarcane ethanol is biofuel derived from sugarcane, a crop cultivated in the United States, Brazil and more than 100 other countries. This clean and affordable renewable fuel helps cut U.S. dependence on Middle East oil and improves the environment.

Why would the United States want to use sugarcane ethanol?

It’s good for energy security. Sugarcane ethanol is a reliable option for diversifying energy supplies and improving U.S. energy security so Americans are not dependent on any one source or country.

It’s also good for the environment. Sugarcane ethanol emits significantly less heat-trapping greenhouse gases than gasoline and other types of ethanol. It is one of the few fuels designated by the U.S. Environmental Protection Agency as an “advanced renewable fuel” because it reduces carbon dioxide emissions by more than 60 percent compared to gasoline on a full lifecycle basis.

I don’t have a car that runs on ethanol. Why should I care?

You probably put ethanol in your tank the last time you filled up at a gas station. Most gasoline sold in the United States today contains at least 10% ethanol, and vehicles built after 2001 can use gasoline containing up to 15% ethanol. American cars and trucks consumed around 19 billion gallons of renewable fuel in 2017, making ethanol an important part of the U.S. fuel supply.

What’s the difference between corn ethanol and sugarcane ethanol?

Ethanol is made by fermenting sugars. Most ethanol manufactured in the United States comes from corn, while Brazilian ethanol is made from sugarcane. Generally, there’s no chemical difference between ethanol produced from one crop or another. However, starchy crops like corn must first be broken down into simple sugars before they can be used to produce ethanol (a two-step process). Since sugarcane produces these simple sugars naturally, the production process for sugarcane ethanol is more efficient (a one-step process) yielding important benefits compared to other plants.

What does it mean to be an advanced biofuel?

The term comes from the Renewable Fuel Standard (RFS), a law requiring increasing volumes of renewable fuel in the U.S. energy supply. The U.S. EPA designates which fuels qualify as advanced biofuels, and the key condition for such designation is demonstrating lifecycle greenhouse gas reductions of at least 50% compared to gasoline. EPA identified Brazilian sugarcane ethanol as an advanced biofuel in 2010 after determining it reduces greenhouse gas emissions by 61%. Stimulating innovation and development of advanced biofuels is a primary goal of the RFS.

Are there other advanced biofuels besides sugarcane ethanol?

Biodiesel and biofuels produced from cellulosic material (any plant fiber, including the non-starch parts of corn plants such as stalks and cobs) also qualify as advanced biofuels. The United States consumes around two billion gallons of biodiesel and renewable diesel annually, and several manufacturing sites designed for commercial production of cellulosic biofuels debuted last year in the U.S. and Brazil. The U.S. Environmental Protection Agency maintains a list of approved renewable fuel pathways that can be used to produce biofuels that qualify as advanced under the RFS.

What about new studies that question greenhouse gas reductions from sugarcane ethanol?

Brazilian sugarcane ethanol producers welcome and continue to support new scientific analyses of sugarcane, particularly its lifecycle emissions. The U.S. Environmental Protection Agency is a key arbiter on this topic, and EPA found that sugarcane ethanol surpasses the 50% threshold for designation as an advanced renewable fuel. In fact, EPA concluded that emissions reductions from sugarcane ethanol exceed the higher 60% threshold for cellulosic biofuels.

How much sugarcane ethanol do Americans use? Can Brazil supply enough to meet our advanced biofuel needs?

Sugarcane ethanol plays a modest but important role supplying the United States with clean renewable fuel. Over the past six years, nearly 1.3 billion gallons of sugarcane biofuel imported from Brazil flowed into American vehicles. During this time, sugarcane ethanol has comprised only one percent of all renewable fuel consumed by Americans, but has provided more than six percent of the U.S. advanced biofuel supply.

In terms of future supply, Brazilian sugarcane producers are making investments to expand production, so Americans can depend on more advanced biofuel from sugarcane. Brazil currently produces more than seven billion gallons of sugarcane ethanol each year and typically makes between 400 million and one billion gallons of its annual production available for other countries to import. By 2020, Brazilian sugarcane producers and the California Air Resources Board estimate that the U.S. may import between 850 million and 1.75 billion gallons of sugarcane ethanol to satisfy America’s demand for low-carbon biofuels.

Could sugarcane ethanol be produced in countries other than Brazil?

Sugarcane ethanol can potentially reshape global fuel markets. More than 100 countries grow sugarcane, and most could produce and use ethanol. According to the Food and Agriculture Organization of the United Nations, only 10% of the world’s land available and suitable for cane production is actually used for sugarcane cultivation. Sugarcane-producing countries are typically tropical, developing countries that would benefit tremendously from this opportunity for significant economic development.

Does the production of Brazilian sugarcane ethanol contribute to deforestation in the Amazon rainforest?

No. The Amazon does not offer the proper climatic, eco-nomic or logistical conditions for commercial sugarcane production.

The Brazilian government has stablished an Agro-Ecologi-cal Zoning (AEZ) program for sugarcane that, among other things, prohibits sugarcane expansion on the country’s most sensitive biomes, namely the Amazon and Pantanal wetlands and Upper Paraguay River basin. At the same time, the government established 64.7 million hectares that are suitable for sugarcane expansion, an equivalent to 7.5 percent of the Brazilian territory. Only one percent of Brazil’s land is currently used for sugarcane production.

Most sugarcane for ethanol production (90%) is harvested in South-Central Brazil, over 1,500 miles from the outside edge of the Amazon. That distance is roughly equivalent to the mileage between Manhattan and Dallas. The remain-der (10%) is grown in Northeastern Brazil, about the same distance from the Amazon’s easternmost fringe.

What’s your position on the Environmental Protection Agency’s proposal to lower renewable fuel standards in 2014?

While Brazilian sugarcane biofuel producers are disappointed that EPA’s proposal significantly reduces target volumes for advanced biofuels below Congressionally mandated levels, we are pleased to see growing requirements for advanced biofuels in 2015 and 2016. This approach leaves the door open for continued American access to sugarcane ethanol, one of the cleanest and most commercially ready advanced biofuels available today.

We urge EPA to set renewable fuel standards encouraging production and consumption of all available advanced biofuels.

What about new proposed requirements on foreign biofuels?

Brazilian sugarcane producers are concerned the regulatory process is being used to impose onerous, anti-competitive requirements on foreign biofuels. In comments submitted to the Environmental Protection Agency, we argued that EPA’s proposed rulemaking is unnecessary and threatens American access to advanced biofuels – including sugarcane ethanol.

But don’t just take our word for it. A growing chorus of biofuel proponents and stakeholders question the need for these changes and their practical impact, as you can see in comments from Chevron, BP America, Shell, Advanced Biofuel Association, Independent Fuel Terminal Operators Association, American Fuel & Petrochemical Manufacturers, American Petroleum Institute and Adecoagro, one of South America’s leading renewable energy companies.

EPA’s intentions are laudable, and we support the agency’s goal of ensuring the regulatory system tracking American biofuel consumption (known as Renewable Identification Numbers or RINs) is accurate. But the current system monitoring foreign producers isn’t broken. Significant protections already guard against RIN concerns, and the Brazilian sugarcane industry worked proactively with EPA to ensure Brazilian producers maintain appropriate records. Plus, there has never been an instance of RIN fraud linked to Brazil. These proposed changes appear to be a solution in search of a problem that will threaten American access to one of the few advanced biofuels on the market today.

What is RenovaBio?

Brazil is poised to launch a government program that will support the continued development and use of low-carbon, clean biofuels. This new initiative, dubbed RenovaBio, will play a key role in meeting Brazil’s ambitious commitments made under the Paris climate agreement.

Brazilian consumers have enjoyed subsidized gasoline prices for many years which weakens demand for ethanol. RenovaBio will alter this dynamic and encourage fuel distributors to boost sales of biofuels versus gasoline by requiring them to lend a hand meeting greenhouse gas reduction goals.

How will this program work?

RenovaBio will seem familiar to Americans because it is modeled on lessons learned from both the U.S. Renewable Fuel Standard and California’s Low Carbon Fuel Standard. The program will assign a Carbon Intensity (CI) rating to the specific biofuel produced at each mill. This system will reward producers who invest in manufacturing biofuels as cleanly and efficiently as possible. Fuel distributors will then be encouraged to buy more of this clean biofuel through requirements to purchase Emissions Reductions Certificates (or CBIOs in Portuguese). Mills that produce fuels with low CI rankings will receive a larger allotment of CBIOs compared to mills producing fuels with higher carbon intensity.

Brazil’s government will adjust the number of available CBIOs and distributor purchasing requirements each year. Fuel producers and distributors will then be allowed to buy and sell CBIOs on the open market – introducing a new price signal that places a value on low-carbon emissions. By providing more predictability for investors and incentives for technological innovation, RenovaBio should help stabilize Brazil’s sugarcane sector and benefit global biofuels players.

Why has Brazil imposed a tariff on foreign ethanol?

UNICA views Brazil’s tariff-rate quota (or TRQ) for ethanol as a temporary solution to what sugarcane producers hope will be a temporary problem. In the run-up to this decision, China and Europe closed their biofuel markets making Brazil the only market that was open to receive excess ethanol supplies. Because of this domino effect, ethanol imports to Brazil skyrocketed in 2017. Brazil received triple the amount of foreign ethanol last year compared to 2016 and five times more than 2015 imports.

Long term, UNICA wants to address this challenge by removing trade barriers and working with other international leaders to expand free trade of biofuels. But in the short term, Brazil’s government needed to act for both environmental and economic reasons.

UNICA advocated and the Brazilian government adopted a temporary response that still allows a large volume of duty-free exports into Brazil. Up to 158.5 million gallons of foreign ethanol can still enter Brazil annually without paying any import tax. For two years starting last September, volumes above that amount – which equals Brazil’s average annual imports from 2014 to 2016 – will pay a 20 percent tax. But there is no limit on the total volume of foreign ethanol that can be exported to Brazil.

In practice, the TRQ maintains what was the status quo before the 2017 spike, while protecting Brazil’s environment and economy from such an unwelcome surge generated by other closed markets.

View additional Frequently Asked Questions on Sugarcane