POLICIES IN THE UNITED STATES

U.S. Sugar Policy

The United States (U.S.) is the fifth largest sugar producer and fifth largest consumer of sugar in the world. The U.S. sugar industry has enjoyed trade protection since 1789 when Congress enacted the first tariff against foreign-produced sugar. Since then, the U.S. government has continued to provide trade support and protection for its domestic sugar industry.

The framework for the current U.S. sugar program has its roots in the so-called “Farm Bill” enacted in 1990. The farm bill is the primary vehicle for setting U.S. sugar policy and that policy is currently based on three main pillars: price support through preferential loan agreements, domestic market controls and tariff-rate quotas.

Price Support

The U.S. Department of Agriculture (USDA) provides loans to sugarcane and sugar beet producers and processors that guarantee a minimum price regardless of the true market conditions. At the end of the loan term (generally 9 months), sugar producers and processors make one of two choices:

1. Turn over to the government the sugar they produced as payment for the loan, or

2. Sell their sugar on the market if the going price is higher than the USDA loan amount

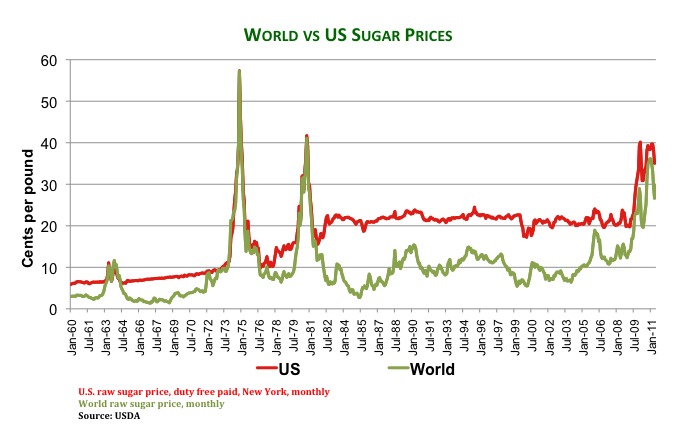

Currently, the average loan rate is US$ 18.61 cents per pound for raw cane sugar and US$ 24.35 cents per pound for refined beet sugar.

Domestic Market Controls

USDA allocates a share of the anticipated U.S. sugar market to sugar producers annually. This allotment basically determines the amount of sugar an individual company is allowed to sell that year. However, these allotments can be, and often are, adjusted based on harvest conditions.

If companies produce more sugar than their allotments permit, they are forbidden to sell it. Instead, they must store the excess sugar at their own expense until they have permission to sell in the future. The Farm Bill requires that these allotments be at least 85% of domestic sugar demand.

Note that marketing loans and marketing allotment programs are contingent on the use of feedstock produced in the U.S.

Tariff-Rate Quotas (TRQ)

U.S. sugar imports are strictly controlled by TRQs. The volume of these quotas is established annually by USDA, and the U.S. Trade Representative (USTR) allocates the TRQs among countries. TRQs are the amount of sugar that can enter the country from abroad at a low or zero duty. The amount set aside for import under TRQs must meet US obligations to the World Trade Organization (WTO) – currently a minimum of 1,117,195 tons of raw sugar and 22,000 tons of refined sugar. The 2008 Farm Bill also allows USDA to increase sugar TRQs on April 1 of each year if a shortage is expected.

Today’s TRQ allocation among 40 countries is based on US sugar trade as it existed from 1975 to 1981. Sugar production and markets have changed substantially during the past 30 years, yet the U.S. sugar quota system does not reflect that evolution.

For 2017 fiscal year, the U.S. allocated a quota of 155,634 tons of raw cane sugar to Brazil which will pay an import duty not to exceed US$ 1.375 cents per kilogram. Additional sugar imports above TRQ levels are not practical or economical under normal market conditions due to stiff over-quota tariffs.

Other Initiatives

International Trade Agreements. The North American Free Trade Agreement (NAFTA) has provided Mexico with tariff-free sugar exports into the US market since January 1, 2008. The Dominican Republic-Central American Free Trade Agreement (DR-CAFTA) also includes attractive sugar provisions that provide those countries with guaranteed TRQs. The import quotas started at a total of 109,000 tons in 2006, grow to 151,140 tons in 2020, and then increase by 2,640 tons per year into perpetuity.

Sugar-to-Ethanol Program. Under another provision of the Farm Bill, the U.S. government can sell excess sugar (for instance, unneeded supplies generated by generous price supports) to ethanol producers at a significant loss. With this program, ethanol producers can pay for sugar the equivalent of what they pay for less-expensive corn. This provision further protects the U.S. sugar market.

Suspension Agreements for Sugar Imported from Mexico. Since January 2015 sugar imported from Mexico are subject to the terms of two agreements suspending an Anti-Dumping (AD) and Countervailing Duty (CVD) investigation that started in 2014 by U.S. International Trade Commission and the Department of Commerce. Since the preliminary investigations found that imported Mexican sugar hurled domestic industry, duties would have to be charged against the imported product. In December 2014 both governments reached an agreement that included export limits and reference prices for Mexican sugar. This agreement was amended in June 2017. The Reference Prices in the amended agreement were set at:

- 28 cents per pound by dry weight commercial value for refined sugar (polarity greater than or equal to 99.2), and

- 23 cents per pound by dry weight commercial value for raw sugar (polarity less than 99.3) loaded in a bulk vessel and freely flowing (not in a container, tote, bag, or otherwise packaged).